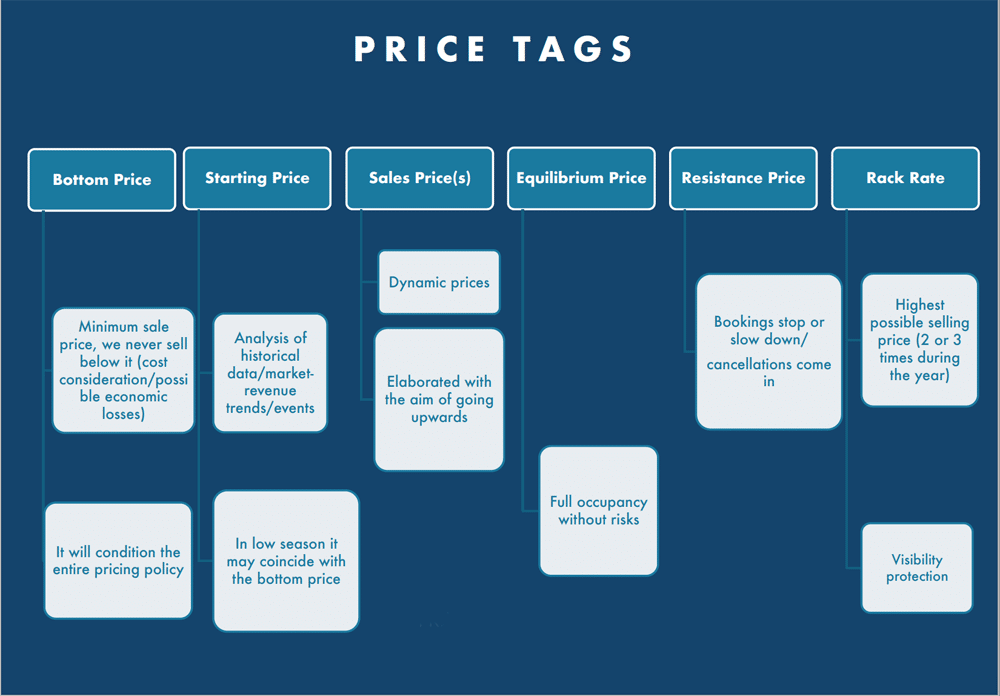

Revenue management underpins six different main types of hotel room pricing. Called dynamic pricing or “price tags,” this article illustrates these various pricing approaches. As you adopt revenue management for your hotel, you’ll want to understand these concepts to interpret the phases of your property’s pricing path to maximize revenues or minimize damages.

Quick menu:

- Hotel Dynamic Pricing Guide; Overview of All Price Tags

- What is the Bottom and Starting Price?

- Dynamic Selling Prices and How You Can Incorporate Them

- Equilibrium Price and Resistance Price

- The Rack Rate

Hotel Dynamic Pricing Guide; Overview of All Price Tags

Below is an overview of all dynamic pricing (Price tag) approaches. In this article, we’ll address and explain all price tags so that you can set the correct room prices for your hotel rooms.

What is the Bottom and Starting Price?

Let’s start with these two types of dynamic hotel pricing. Bottom and starting prices are closely related but have slightly different nuances.

The Bottom Price

The first dynamic pricing approach is the bottom rate. The bottom rate is the minimum selling rate. Your hotel won’t go below this rate for three reasons:

- Economic limits (costs would exceed revenues, and there would be a loss)

- Psychological/brand limits (resistance to accepting to fall below a certain subjective price threshold)

- Legal (imposition of local authorities)

When we talk about costs considered in the processing of the bottom rate, we refer to variable costs, which are incurred only in occupied rooms.

You can consult this article for an accurate overview of calculating and analyzing fixed and variable costs.

It’s fundamental to define the bottom rate for the hotel room. This rate enables us to penetrate the market in periods of low demand or the last-minute phase in case of high unsold volume.

Here’s How it Works

Bottom rate pricing allows the property to increase visibility and stimulate demand at certain weak times of the year. Such rates also generate many bookings, which result in positive reviews due to the excellent value for money. Such reviews are essential to dynamic pricing because they improve the hotel’s visibility even in the high season.

It all works together, contributing to your best rates regardless of the season.

Therefore, a correct bottom price in the low season has direct and positive repercussions on the entire revenue management policy for the hotel. It can even help you sell at stellar rates in the high season. For example, a bottom rate of 59 $ for a 3-star hotel in the low season could be necessary to sell at a maximum rate of 599 $ in the high season.

The Starting Price

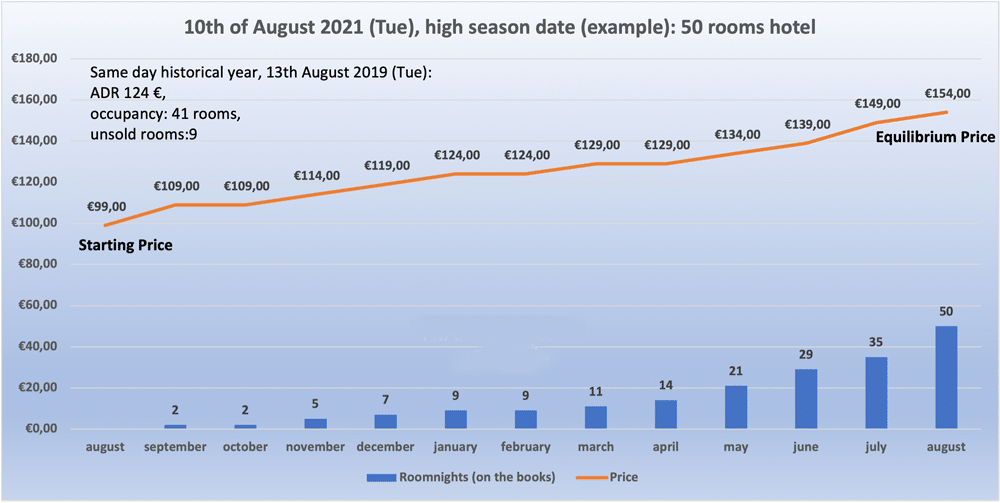

Now that we’ve established a baseline for the bottom price, let’s move to the following dynamic pricing approach, the starting price. You decide to apply this initial price to your rooms at least a year in advance. Price exposure is essential for revenue management techniques to work at their best. When rates are advertised at least a year in advance, they have the time to perform their best and intercept the market segments at the right time.

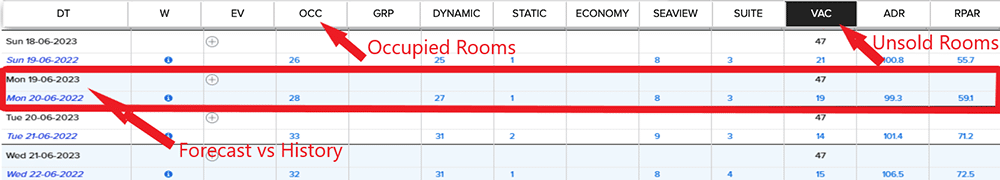

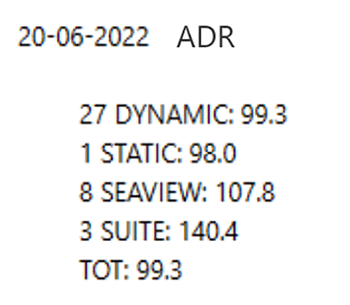

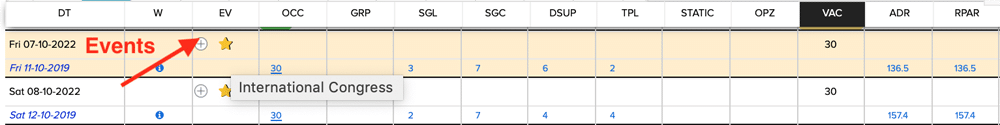

Analyzing your historical data from the previous year is one of the first criteria to establish a correct starting price. For example, if you have to process the starting price for Monday, June 19, 2023, you will analyze the historical data of the exact date of the previous year. In this case, the reference will not be the cardinal number (June 19) but the comparable day of the week (Monday, June 20, 2022).

As a revenue manager, you’ll analyze how many rooms were occupied on that date and at what price. You’ll also review the pick-up and average rate for each type of room, channel, and market (dividing between dynamic markets such as OTAs and static markets like tour operators.) Dynamic markets work with the free sale and dynamic rates, and static markets work with allotments and fixed negotiated rates. The unsold rooms volume and Revpar provide additional elements of analysis. An RMS (revenue management system) integrated with your PMS (property management system) can give you all this data.

With data in hand, you can start processing the starting price for the date in question for each type of room and each dynamic and static channel.

Covid has made historical data a more articulated and complex concept. Some analysts argue that Covid has eliminated the importance of historical data.

Stating that historical data has lost relevance is equivalent to saying that revenue management has lost relevance. Its essence is analyzing the past to predict the future and maximize profits.

And when the previous year seems useless to be compared for any negative or positive reason, it makes sense to use the most relevant historical year ever as your reference, even if it’s 2 or 3 years behind.

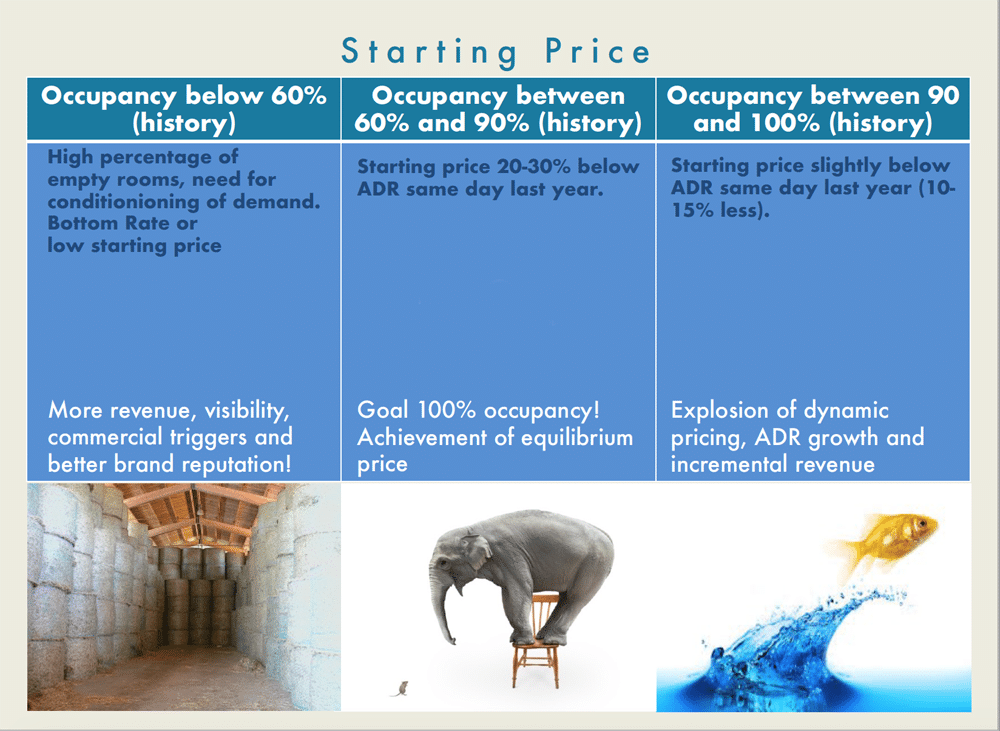

The starting price’s objective will differ depending on the data indicated by the property’s history. The lower the volume of the unsold room, the higher the starting price. The higher the volume of the unsold room, the lower the starting price, at the point of coinciding, in some cases, with the bottom rate. In these cases, the distance between the starting price and the historical ADR (average daily rate) will be directly proportional to the number of unsold rooms.

Here’s an example of this approach with some indications.

Of course, the wisest thing to do for a new property without historical data would be to monitor the local market performances to get an idea of how to position itself initially. Then applying a starting price as low as possible (covering variable costs, of course) in line with each period and season.

Be cautious with the inventory distribution and ready to increase prices as the pick-up, demand, and lead time would indicate.

This way, you will build your history and use it as a future-year baseline.

Other Historical Variables

Now, you may wonder what other parameters can your historical data offer as you determine your starting price. Such other variables include:

- Presence of predictable and planned events well in advance (trade fairs, concerts, major sporting events, etc.)

- Market trends or macro factors (level of the competitive set, improvement of the destination’s attractiveness, etc.)

- Revenue trend or micro factors (brand reputation, visibility, and ranking of the property)

The practice suggests that, despite the history of 100% occupancy, we start with prices slightly lower than the historical ADR (average daily rate) and then react to the prices according to the demand trends. However, there are cases where it may be necessary and reasonable to start higher than the historical ADR, even when the historical data indicates a percentage of empty rooms.

For example, in the presence of events that are not historically recorded but suggest a large influx of people, it may make sense to start higher than the historical ADR.

Other examples include:

- A group traditionally accepted at meager rates can affect your rate.

- The destination has enhanced visibility due to world events (Olympics, Expo, World Cup, etc.)

- Infrastructure improvements such as airports, rail, or road networks can draw interest.

- Other investments through events or other positive reasons draw attention to an area.

- There could be a revenue trend in which the property naturally improves its online visibility year over year.

In the latter case, revenue management and its dynamic pricing component improve online conversion rates. Higher conversion rates lead to higher rankings in search engines. Property upgrades and online reputation improvements can also enhance visibility. Greater visibility leads to the possibility of adopting higher starting prices than those that historical occupancy and ADRs would indicate.

As you can see, developing a starting price for any day of the year requires many criteria to analyze, but it’s worth it to guarantee success. In some cases, medium or small properties have found that finding the right starting price can affect the chances of getting a final successful result by up to 60%. In other words, the correct starting price significantly impacts the results.

The starting price is the basis for your hotel’s dynamic pricing in the different pricing approaches. There may be times when the bottom rate coincides with the starting price. This usually happens when the property’s history indicates a low occupancy rate. In those cases, the bottom/starting price may remain flat until the arrival date and never change.

Dynamic Selling Prices and How You Can Incorporate Them

The essence of Revenue Management is the art and science of dynamic pricing. Hotel revenue managers recognize that empathizing with the market brings enormous advantages.

If you realize the starting price requires analyzing predictable variables, you may also recognize that dynamic pricing evolution includes less predictable variables.

Move your room rates in the best possible way at that time requires:

- Historical variables

- Forecast variables

The baseline for analyzing a date is to ask, “What was the situation last year on the same date as this year?”

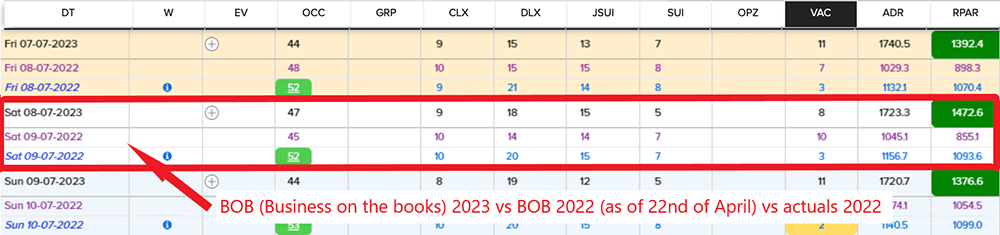

Since revenue managers analyze the short, medium, and long-term forecasts, they want to know how the hotel performs today and tomorrow and what the outlooks are for the months ahead. It is essential to compare the historical BOB (business on the books) with the current/forward one, the pace report. For example, if on April 22, 2023, we examine Saturday, July 8, 2023, it can be beneficial to understand the situation on April 22, 2022, for the comparable date of July, Saturday, July 9, 2022.

The revenue manager will consider how many rooms were occupied then? At what rates? From which channels? Are we going slower? Why? Is it due to internal factors (worsening brand reputation or higher rates than the historical one?) Are there any negative events affecting the destination in the news?

Or are we going faster? Should we raise the prices? Should we stand still? Are we selling too much? Is it due to improving our online conversion rate and brand reputation? Is there any event that we did not take into account?

There are many variables to examine, and they are linked to three factors: pick-ups, distance to the date (how much time is left to sell the rooms), and sales channels.

Pick-ups and Lead time

Pick-up is the number of rooms sold daily or weekly for a specific type of room, for a certain date, and at a particular price.

How many rooms do we need to sell before eventually raising the rates? And how much do we have to raise? 5 $? 10 $? 20 $? 50 $? You cannot automate this operation with a simple rule if you do not consider other key variables, namely time and sales channels.

For instance, selling ten rooms for a particular date in 10 months is entirely different from selling ten rooms for the same date in 10 days. And consequently, so will the actions that we are going to perform.

Additionally, selling ten rooms to a tour operator or a group at negotiated flat rates is entirely different from selling ten rooms on online channels at dynamic rates.

To evaluate the appropriate pricing actions, you need to know several things.

- How many rooms have historically sold for different price points, such as $99, $109, and $119?

- On which channels?

- How long in advance?

Equally important is to know the average booking window (or lead time) of your property and your destination. In other words, when do online searches (and, therefore, reservations) become increasingly frequent? When do they reach a peak, and when do they slow down and stop (subsequently making any online pricing action useless?)

This window can change from destination to destination, oscillating between 45-10 days for holiday destinations or those that live mainly on medium-long haul traffic and a range of 20-1 days for more urban destinations or metropolises that rely on short-haul traffic. Much of the pricing dynamism and the final result is at stake in that time frame.

Knowing the average booking window allows you to manage other price types that complete the path of dynamism, namely the equilibrium price, the resistance price, and the rack rate.

Equilibrium Price and Resistance Price

Two other dynamic pricing approaches are equilibrium pricing and resistance pricing. The equilibrium price reached in the average booking window, where demand and supply meet at an ideal point, allows the hotel to fill the last rooms and obtain the result without risk. For example, the maximum occupancy at an ADR higher than the previous year increases turnover.

Analyzing historical data, crossed with pick-ups and the market and revenue trends identify the best possible equilibrium price.

However, it is sometimes impossible to achieve this optimal situation because internal or external factors can take over. Such factors can lead to incorrectly raising the rate and running into the so-called resistance price, resulting in a block or slowdown of reservations or cancellations.

The reasons can be the most disparate:

- an excessive or too fast increase in prices

- a worsening of brand reputation

- unfavorable weather close to arrival

- a canceled event

- an economic crisis

- Even incorrect commercial and pricing management of other hotels can affect the entire market.

Sometimes, meeting the resistance price can mean balancing, limiting the damage, and getting the best result. As a result, a hotelier may have to adopt the necessary corrections to what could seem like a perfect price curve.

One of these corrections is a last-minute price, a discounted rate applicable when the cancellation policy prevents us from possible cancellations and rebookings at a lower rate. It can be gradual or drastic depending on the number of rooms to be sold, the time available to do so, and the average booking window of the destination.

The last-minute rate could coincide with the return to an equilibrium price or similar in low unsold room volume cases. Sometimes, it may make sense for the room to be priced at the bottom rate if someone made serious pricing errors and the property has to deal with heavy unsold volume close to the date.

Navigating between equilibrium and resistance prices is one of the most complex and exciting tasks in revenue management and often indicates the revenue manager’s most spillage (cautious) or spoilage (reckless) attitude.

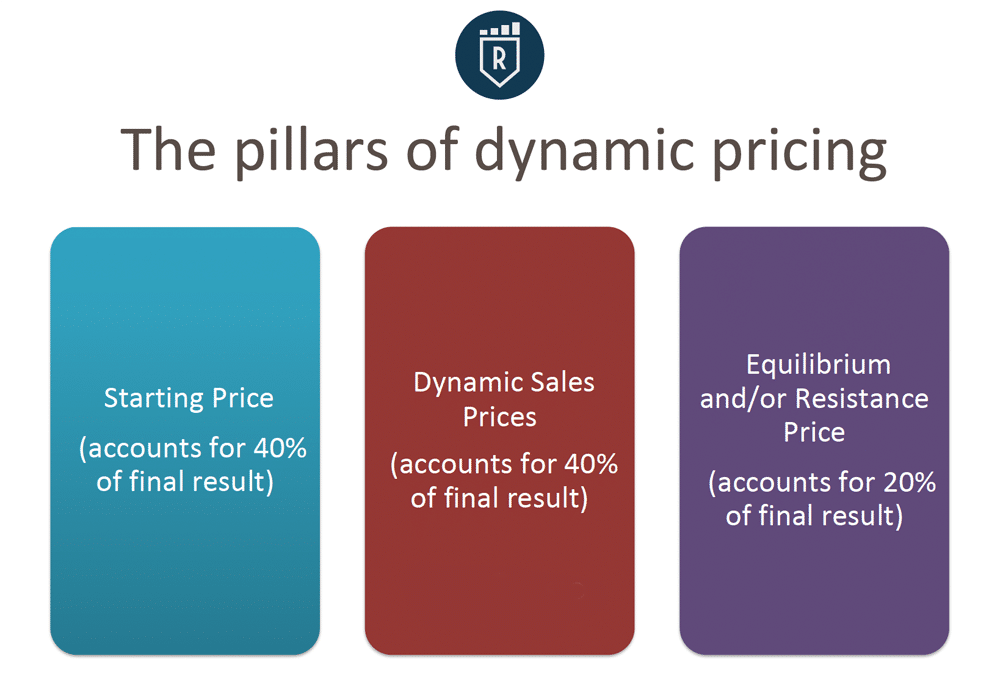

If we want to summarize this scheme with the weight of each price on the final result, we could identify these areas:

Then there are cases in which the pricing dynamism reaches very high peaks at the end of its path, coinciding with the so-called rack rate.

The Rack Rate

The last dynamic pricing approach is the rack rate. This rate is traditionally the maximum possible sales price. In some countries, it’s the one that must be declared to the local authorities to comply with regulations and is posted on the door of the rooms or behind the reception counter.

It is an extremely high rate; to be defined as such, it is sold a maximum of 2 or 3 times during the year. For example, during events of planetary importance, such as the Olympics, or on occasions of very high demand, such as New Year’s Eve. It can also maintain online visibility in periods of high demand when the property is fully booked.

Instead of stopping online sales, a percentage of possible cancellations might be expected, so you consider compensating for them with new bookings (strategic overbooking.)

A rack rate sold frequently in revenue management is probably low, and an even higher one must be declared to the relevant authorities (in those countries where applicable.)

While it is true that the bottom rate can often coincide with the starting price, the rack rate rarely coincides with the final price.

Revenue management, and precisely one of its main components – dynamic pricing- is a complex art (creation of a strategy) and science (analysis of numbers). Revenue management blends the scientific, analytical, and objective parts (starting prices) with pricing dynamism’s more subjective and interpretative element.

Today, a great RMS (Revenue Management System) helps cross-reference the correct data and AUTOMATE much of all the analysis, calculations, and decisions described above. The property will increase turnover if the RMS is set up and supervised by an excellent HUMAN revenue manager (hired or outsourced.)

This person creates and configures the best possible commercial strategy and then coordinates the reservation/front desk staff, PMS, RMS, channel manager, OTAs, etc. All the inputs received are converted into valid outputs and outstanding profits.

Such software helps outline an optimal sales strategy (choice of distribution channels, the architecture of the room types offered, sales conditions, cancellation policy, etc.) The software developed by hoteliers and revenue managers of the Franco Grasso Revenue Team will ensure you have the relevant data to inform your revenue pricing strategy.

Such RMS strategic inputs result in the definition for each day of the year for the bottom rates (after cost analysis), starting prices, dynamic, equilibrium, resistance prices, and rack rate. Then, each is distributed daily on all sales online and offline platforms and monitored by human revenue managers.

Free Guide: 10 Things To Know About Revenue Management

Hotel Revenue Management is an innovative economic discipline involving the harmonious and integrated use of sales channels, distribution strategies, and market-oriented dynamic pricing to obtain the highest profits from each hotel.

This ebook introduces revenue management for executives, general managers, and hotel owners. In the ebook “10 Things To Know About Revenue Management”, you’ll learn the revenue management principles. Click here to download the Guide “10 Things To Know About Revenue Management”.

As you can see, dynamic pricing or “price tags” are a complex yet profitable avenue to greater hotel profitability. It starts with the right data inputs to determine the correct base bottom and starting prices. Once you have those, you can adjust for other factors. Do you have your bottom and starting rates?

More Tips to Grow Your Business

Revfine.com is the leading knowledge platform for the hospitality and travel industry. Professionals use our insights, strategies, and actionable tips to get inspired, optimize revenue, innovate processes, and improve customer experience.Explore expert advice on management, marketing, revenue management, operations, software, and technology in our dedicated Hotel, Hospitality, and Travel & Tourism categories.

Leave A Comment