Are you a hotelier struggling to maintain rate parity in today’s ever-changing hospitality industry? If so, you’re not alone. Despite the challenges of the last few years, rate parity remains a significant issue for hotels, and it’s only getting more complicated.

Top 3 Hotel Rate Parity Issues

As a result of the pandemic, many hotels focused on generating short-term business and revenue, often at the expense of rate parity. However, maintaining consistency across distribution channels has become increasingly important with the industry’s evolution. Here, we will explain three hotel rate parity issues, and then review the best way to solve them.

1. The Rise of ‘Bait-and-Switch’

One of the biggest challenges hotels face today is the practice of bait-and-switch, where potential guests are presented with an attractive, misleading, money-saving opportunity. For instance, a guest may find a lower rate for a particular package on a metasearch engine than on the hotel’s official website.

However, when the guest clicks through to investigate further, they may discover that the rate has increased and is now equal to, or even higher than, the rate on the hotel’s website. This can frustrate guests and drive business away from the hotel’s brand.

Bait-and-switch can occur in several ways, but one of the primary reasons is through non-contracted OTAs. Wholesale rate leakage is a common issue, where wholesale rates meant for business-to-business transactions result in lower rates than what is available on the hotel’s official website.

Caching is another way that bait-and-switch can take place. Guests may reach a point in their booking journey where they discover that the rate has expired, and a new, higher rate appears, or they may be advised that the hotel or room type they had wanted is sold out and no longer available to be booked.

Another common trick used to make rates appear cheaper than the actual bookable price is adding taxes or other fees at the end of the buying journey. This can lead to guests feeling misled and drive business away from the hotel’s brand.

Keeping an eye out for the latest trends is crucial, and an additional parity issue that has been making waves lately is the concept of ‘metaception’. It’s a trend that shouldn’t be overlooked and has the potential to impact your bottom line.

2. The Deceptive Practice of Meteception Exposed and Explained

In essence, metaception is when an OTA serves as both a traditional OTA and a price comparison metasearch site. This can be confusing and makes it difficult for hotels to identify the root cause of their parity issues, resulting in a potential hit to their direct booking revenue.

Here’s how metaception works: a hotel distributes its inventory to a contracted wholesaler or bed bank, who may resell it to another wholesaler. This wholesaler unbundles the package rate and sells it to an OTA. Although hotels may not have contracts with metasearch sites, their rates are still aggregated based on customer search requests.

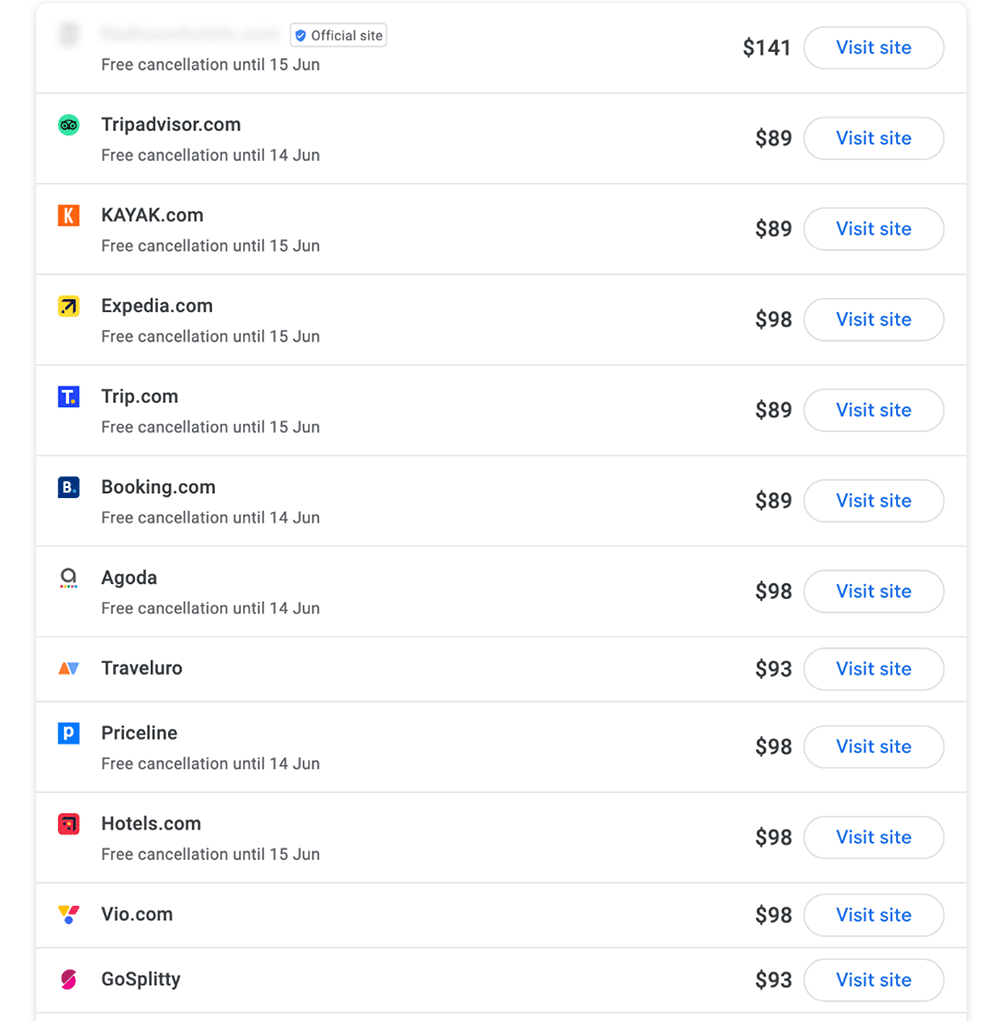

The rates appear on a metasearch site, listed and ranked – as in the image below.

The unbundled rates appear and link to the OTA, while the rates on the hotel’s website remain the same.

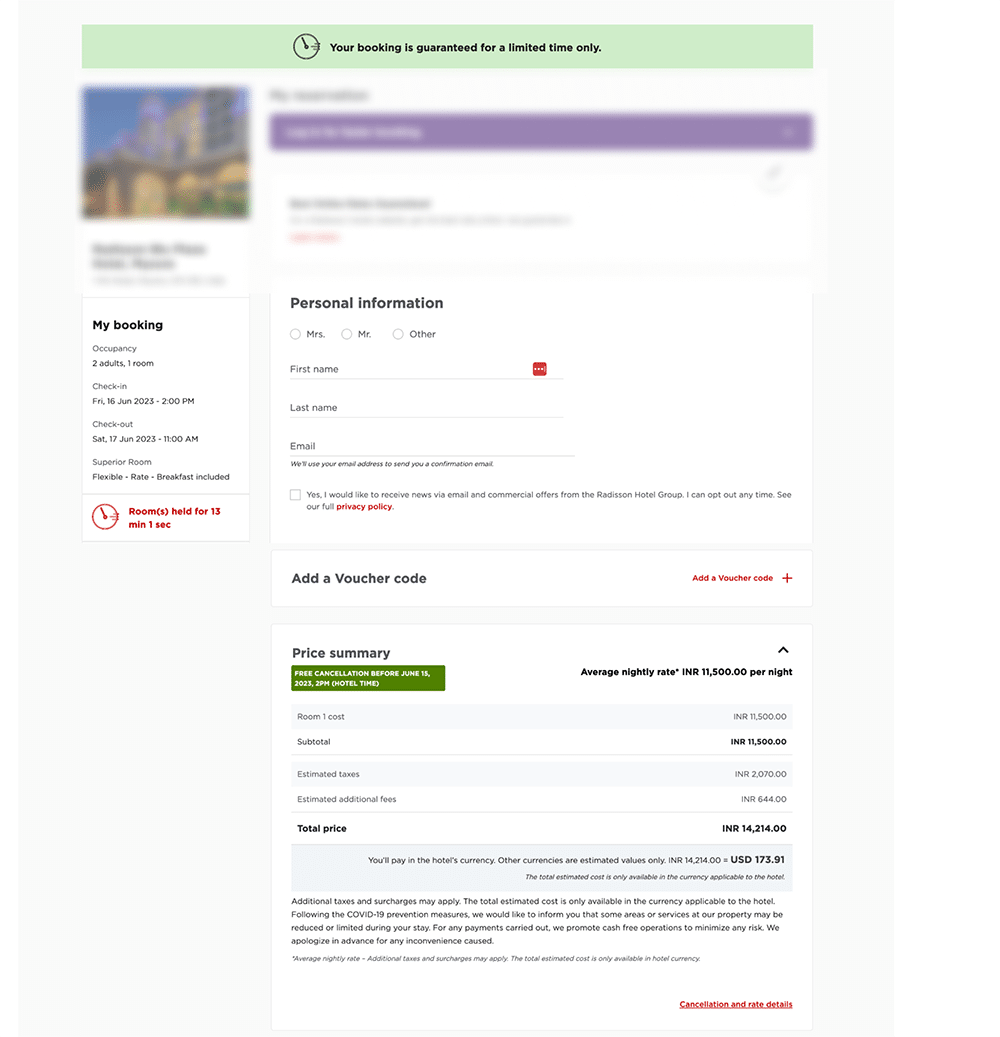

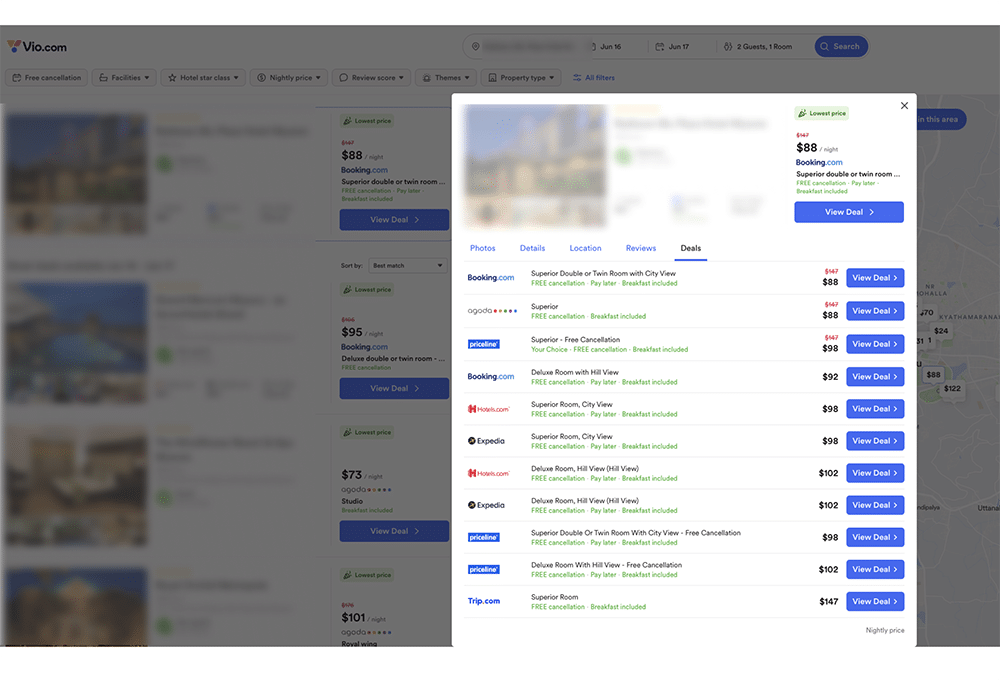

When prospective bookers see a cheaper rate, they click on the link, directing them to another website, which opens up as another metasearch site.

Either the cheaper rate is on this site and is bookable there, in which case it functions as an OTA, or the cheaper rate will appear again, and the guest will be redirected to a major OTA.

These bad players are incentivized as the metasearch site earns money off the click and the booking when it functions as both an OTA and a metasearch. While guests may benefit from finding a good deal on these metasearch sites, hotels are often left as the only losers, with OTAs getting more business and metasearch sites earning money from the click.

To combat this issue, Google and TripAdvisor have implemented price accuracy policies, requiring metasearch sites to display accurate hotel pricing information. However, misleading practices still exist, as was pointed out by Expedia, which recently urged Google to ensure a fair marketplace by eliminating these tactics.

Hotels can take screenshots of any discrepancies they find and bring them to the attention of the metasearch site in question. However, the multiple layers of deception make it difficult to discover whether they are losing money through wholesale leakage or if your contracted OTAs are violating the contract.

3. AB Testing, OTA Promotions, and the Struggle to Maintain Rate Parity

The hotel industry faces even greater challenges in managing rate parity due to the COVID-19 pandemic. Using various discounted rates and policies to encourage bookings has given OTAs more power, causing concern among hoteliers regarding rate distribution management.

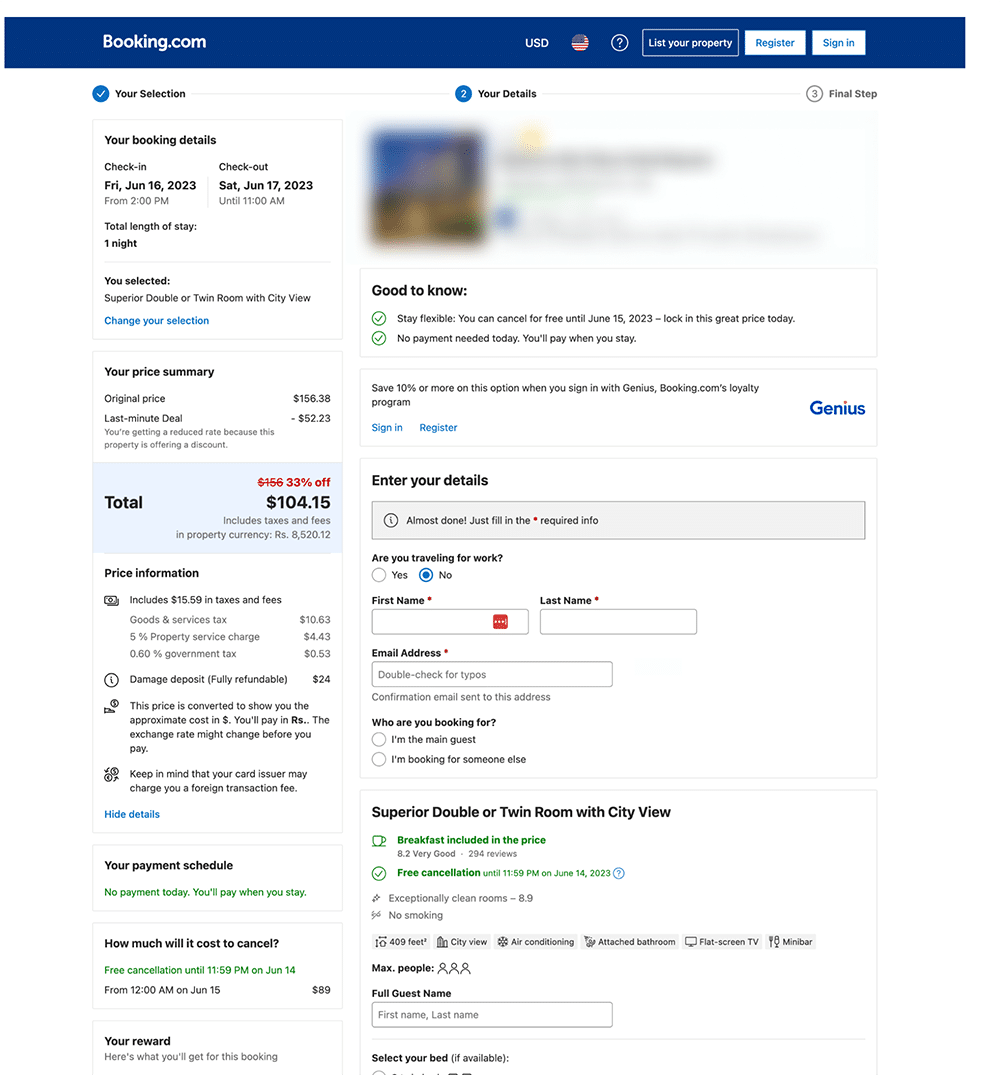

One example is Booking Sponsored Benefits, an advanced payment program offered by Booking.com that allows guests to access exclusive benefits, including discounts, when they prepay for their stay. The program intends to encourage guests to book directly through the platform while providing added value.

Using machine learning, the OTA displays a lower rate to the guests to encourage them to book. Although this benefit eats into the OTA’s commission, it drives more traffic through its platform and maintains customer loyalty.

While the Sponsored Benefits program offers benefits to hoteliers, such as increased visibility and potential bookings, it also presents challenges in managing rate distribution. Rates are displayed lower than anywhere else, making maintaining price parity across all channels difficult. This can lead to conflicts with other distribution partners and reduce marketing spend effectiveness on metasearch sites.

Moreover, the program diverts traffic from hotels’ websites, reducing their direct booking volume and affecting distribution costs.

Although OTAs with more power can benefit hotels, they also pose challenges in maintaining rate parity and managing rate distribution. Hotels need to be aware of these challenges and take steps to mitigate them, such as negotiating contracts with OTAs that ensure rate parity and incentivizing direct bookings. By doing so, hotels can protect their profitability and maintain a healthy distribution strategy.

What’s the Best Way to Solve These New Parity Issues?

To combat these challenges, you should adopt a more integrated approach between marketing and distribution.

Become increasingly strategic about your investments in SEO campaigns and recognize the importance of competitive rates to achieve desired results.

Pause campaigns on specific dates until rate parity issues are resolved, ensuring your marketing investments effectively drive bookings and revenue. Predictive demand intelligence is useful for hoteliers to understand where demand is coming from and when enabling them to deliver more strategic marketing investments.

A data-centric approach is crucial to a successful parity strategy, with a channel manager as a starting point to identify problem areas and address them with contracted OTAs in real time. You should also focus on meta-search engines and smaller non-contracted channels, conducting test bookings to identify wholesale rate leaks and monitoring them closely.

Software like Lighthouse, has solutions to help hotels of all sizes monitor in real-time which rates are appearing on OTAs and metasearch, enabling you to spot any discrepancies between your website and third-party channels.

Establishing a clear escalation process to tackle offenders according to the severity of the parity violation and building a solid case with supporting evidence is also important. You should periodically review your partnership strategies to ensure they provide a symbiotic relationship based on collaboration and true value for the hotel.

By taking these steps, you can maintain rate parity, protect your profitability, and maintain a healthy distribution strategy in the face of the challenges posed by an ever-shifting distribution landscape.

Whitepaper: Predicting Hotel Demand with Short-Term Rental Data

This whitepaper will show you how to identify changes in short-term rental demand and adjust your pricing and marketing strategy for the appropriate periods ahead of your competition to accelerate growth.

Click here to download the whitepaper “Predicting Hotel Demand with Short-Term Rental Data”.

More Tips to Grow Your Business

Revfine.com is the leading knowledge platform for the hospitality and travel industry. Professionals use our insights, strategies, and actionable tips to get inspired, optimize revenue, innovate processes, and improve customer experience.Explore expert advice on management, marketing, revenue management, operations, software, and technology in our dedicated Hotel, Hospitality, and Travel & Tourism categories.

Leave A Comment