Ask any hotel staffer not directly involved in revenue management about the daily tasks of a revenue manager, and they’ll likely suggest it’s all about ‘setting’ or ‘raising rates.’ While these activities are indeed crucial, they often eclipse the comprehensive analysis that underpins each pricing decision.

Five Rate Mistakes in Revenue Management and How You Can Solve Them

As a revenue manager, focusing entirely on pricing can inadvertently lead your hotel off course, resulting in less-than-optimal revenue outcomes. Numerous pitfalls await when it comes to finding that ideal price point. In this article, you’ll find five of the most common mistakes I’ve encountered throughout my career.

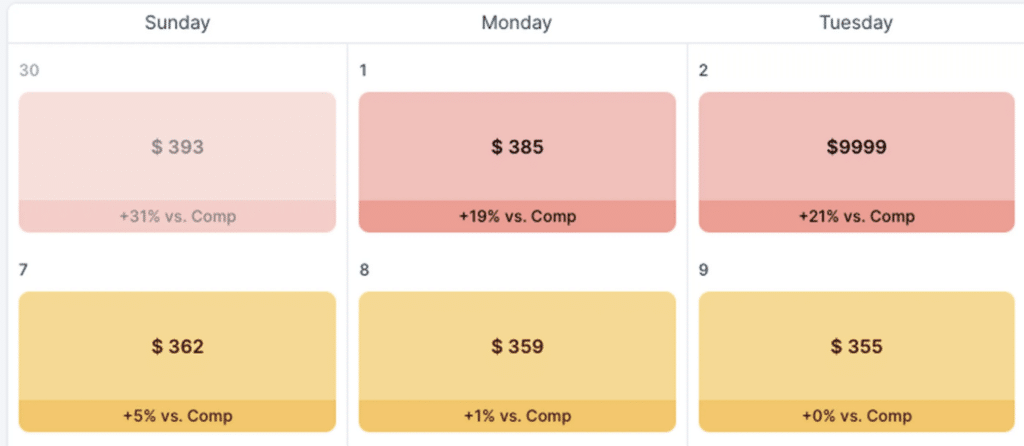

Mistake 1: Overpricing as a Defensive Strategy

Does this scenario sound familiar? A major event is announced, and under time pressure, you input a placeholder price of $999 to deter bookings, buying you some time to devise a more logical pricing strategy.

This approach, however, is a fundamental error for several reasons:

A hotel’s Best Available Rate (BAR) or RACK rate isn’t the only rate a revenue manager needs to consider. Remember, static, flat, and negotiated rates don’t necessarily move in tandem with a $999 RACK rate.

Elevating your rate to an unrealistic level can create a “challenge accepted” mindset among shoppers. If demand is high, expect such a rate to push potential guests towards unconventional booking channels. It’s not unusual to see an increase in points stays/redemptions, flat LNR rates, and other accounts with Last Room Availability.

In essence, what was meant as a quick, time-saving method to protect inventory can cause more issues unless paired with a stellar yielding strategy. Ironically, this strategy requires just as much time as correctly pricing the hotel from the outset.

The Fix: Take a step back and implement a comprehensive strategy that includes a realistic price point, logical yielding, and practical policies to avoid setting an unintended challenge for potential guests.

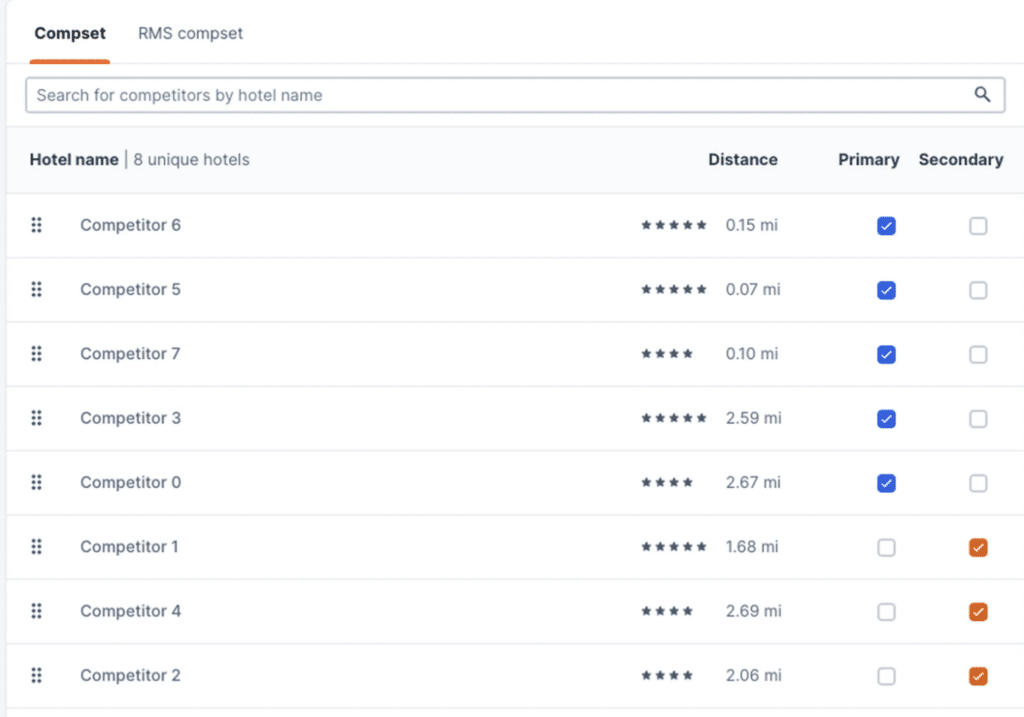

Mistake 2 – Pricing Decisions Based on an Inappropriate Competitive Set

This mistake might seem so fundamental that you’re tempted to dismiss it. However, consider the ways in which we construct competitive sets (or compsets) that may not serve your best interest.

As a revenue manager, you may feel pressured to compare your hotel against others that clearly don’t belong in your competitive set. Over time, your compset might include hotels that don’t even share the same lodging type.

For instance, adding an economy extended stay property to your compset while you operate an upper-midscale select-service property is a common error that can lead to sub-optimal pricing decisions.

We, as revenue managers, are competitive by nature, always striving to outperform as many other hotels as possible. But it’s essential to step back and ask: “Is my compset realistic?”

The Fix: Be realistic with your primary compset and use a secondary compset for that “stretch” compset. Monitor those competitors that might not be an exact match but are still significant to your business.

Mistake 3: Not Reviewing Your Rate Shop Compset Annually

This point is closely related to mistake two but has subtle differences. How often have we, as revenue managers, taken over a hotel assignment and simply continued without questioning the compset?

Perhaps you’re in a rapidly growing market and haven’t taken the time to assess whether new supply poses a threat?

If you haven’t revised or updated your compset in the past year, you might be surprised by how much has changed: new supply, brand conversions, and renovations all warrant a fresh look at your compset.

The Fix: Schedule strategy meetings at least once a year to review changes in your market supply and adjust your rate shop competitive set accordingly.

Mistake 4: Ignoring Market Mix when Making Pricing Decisions

Market mix should always be a consideration when making any revenue management decision. Yet, one of the most common pricing errors is making pricing decisions in isolation, detached from the realities of market mix.

Consider this scenario: a revenue manager significantly raises rates due to a large amount of blocked groups. Then, the groups hit their cut-off date and either cancel entirely or wash heavily, leaving the revenue manager to scramble and drop rates to fill the hotel with last-minute transient business, thereby eroding their Average Daily Rate (ADR).

Monitoring key statistics, such as the “Bar-based” mix (or stays that derive from the hotel’s BAR), can reflect the success of your current pricing strategy and help keep pricing decisions on track.

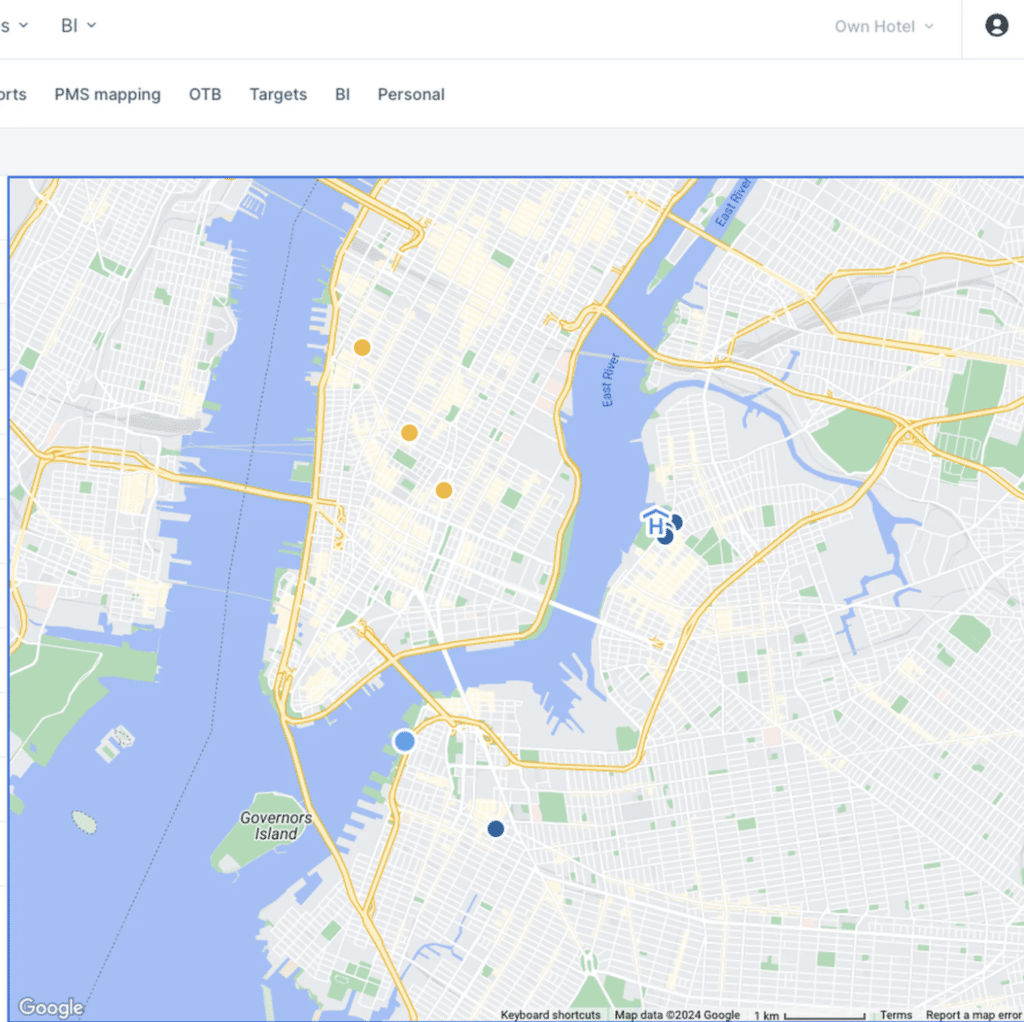

The Fix: Use a Business Intelligence (BI) tool like Lighthouse Business Intelligence to monitor your market mix throughout the entire booking curve, ensuring your pricing strategy aligns with your market mix.

Mistake 5: Overlooking Guarantee and Cancellation Policies when Making Pricing Decisions

Policies often take a back seat to pricing decisions, but that shouldn’t always be the case. Guarantee and house policies can complement your pricing decisions, yet too often, revenue managers focus solely on rates, especially during high-demand periods and special events.

Consider this: if I’m planning to attend a major music festival in six months, a fully refundable $999 rate is less intimidating than a non-refundable $699 rate, especially during the early planning stages. If I book the refundable rate, the chances that I cancel the $999 booking are significantly higher. I’ll likely book a better deal as soon as I find one, but it’s too early in the booking curve to commit to the $699 non-refundable booking.

A savvy revenue manager will balance the sell rate with reasonable cancellation policies throughout the booking curve, ensuring guests not only book but are also serious about staying and not merely using the reservation as a placeholder.

Setting a market-appropriate RACK rate with slightly more restrictive policies is usually a winning combination for high-demand dates. This approach helps stabilize your forecast by reducing cancellations and securing more guaranteed revenue.

The Fix: Perform a deeper analysis of the policies competitors implement during high and low-demand periods. Put yourself in a prospective guest’s shoes and ask: “Where would I stay?” given the combination of price and policies you find. Adjust if your price and policy combined aren’t cohesive and appealing to potential guests.

This list should provide you with a solid starting point and awareness of the pricing mistakes to avoid. The fewer pricing mistakes you make, the more top and bottom-line revenue you can drive to your property. Over time, a consistent, high-quality pricing strategy will significantly impact your overall performance.

Whitepaper: Predicting Hotel Demand with Short-Term Rental Data

More Tips to Grow Your Business

Revfine.com is the leading knowledge platform for the hospitality and travel industry. Professionals use our insights, strategies, and actionable tips to get inspired, optimize revenue, innovate processes, and improve customer experience.Explore expert advice on management, marketing, revenue management, operations, software, and technology in our dedicated Hotel, Hospitality, and Travel & Tourism categories.

Leave A Comment